Decentralized underwriting

An Insurance DAO (iDAO) is a DAO devoted to the work of underwriting insurance policies. An iDAO consists of member underwriters who sell insurance policies to non-member customers, creating a decentralized underwriting market. Tokenomics formulas give numerical estimations for premia pricing as a function of risk which predicts valuations for the market and the likelihood of iDAO ruin[1], which dictates the capital or reserves required for an iDAO.[2]

iDAOs under DGF can be more efficient than traditional insurance companies, since REP tokens in an iDAO can serve as substitutes for capital reserves depending on the degree of decentralization of the iDAO.

Overview[edit | edit source]

Insurance is essential for every type of business transaction, every type of property, every type of service engaged in business. Every type of economic action is made more efficient when decisions are hedged, so we can be more confident in our investments in the future. Such stability allows more complex business arrangements which exploit subtler opportunities for profit. To achieve this stability, we require the trust that transactions will finalize satisfactorily as planned, or in the event of unforseen failure, that the contract will be made whole by the platform running the marketplace.

Therefore insurance is an essential industry for the modern economy. Like the appeals process of the law, like policing, like the effort to keep track of reputation and maintain the protocols of governance, insurance is also an overhead cost that does not directly generate profit. It’s a type of business cost that any efficiency-minded engineer would prefer to eliminate entirely. But inasmuch as we can’t predict the future, insurance will never be eliminated, because it is valuable. Insurance improves the efficiency of the economy by investing in the future, to guarantee the system will continue running, despite inevitable unforeseen problems. Insurance mitigates risk. Insurance helps people overcome the fear of joining a business transaction due to the risk of loss. In physics jargon, insurance is a business catalyst, which provides activation energy for a transaction.

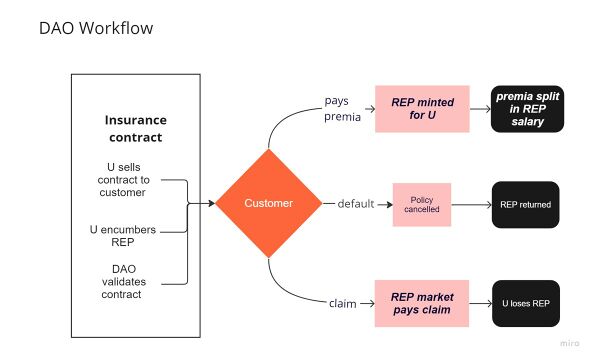

Decentralized insurance requires networks of policy writers with individual reputations for efficient underwriting of every type of transaction. In the basic iDAO workflow detailed below, which follows the basic DGF workflow, there are three crucial but unintuitive steps:

- An underwriter gets new REP, instead of cash from premia, for selling contracts.

- All premia are given to the entire iDAO (REP salary), not the underwriter who risks REP.

- A claim is paid by a REP market which auctions the particular underwriter’s REP tokens. Underwriter loses REP, not money directly. And the risk is not covered by the entire iDAO, but only the specific underwriter who issues the contract.

Insurance DAO protocols[edit | edit source]

Components[edit | edit source]

- iDAO = {Underwriters}

- Underwriter ∋ REP tokens

- Propose contracts with REP

- Police contracts with REP

- Insurance contract (Work smart contract)

- Validation Pool

- REP-to-BOND market

Token scheme[edit | edit source]

The following basic workflow illustrates how an iDAO creates REP tokens and distributes premium cash money from customers.

Workflow[edit | edit source]

(See Figure 1.)

- Underwriter sells a contract to a customer.

- encumbers the canonical amount of REP in the contract.

- Contract Validated by DAO.

- Customer

- pays premia, or

- defaults, or

- claims

- iDAO

- mints REP for proportional to premia & distributes REP salary, or

- cancels contract, or

- pays claim by burning encumbered REP and minting sufficient BONDs to cover the claim (REP-to-BOND market)

Figure 1: iDAO workflow follows basic DGF workflow iterated each time a premium is paid

Notes:

- If a customer makes a claim on the policy, the contract governs how the claim is validated. Typically an oracle and an adjudicator are necessary for this step, which are outside the scope of this specification.

- If a claim is validated, the underwriter's encumbered REP is auctioned at market to pay the claim.

- If the auction price of the encumbered REP is sufficient to cover the claim, and excess cash or REP from the auction is returned to the underwriter.

- If the auction price of the encumbered REP is insufficient to cover the claim, further REP is minted and sold at market until the claim is covered. Any excess cash from this process is donated to the iDAO's capital reserve.

- In practice, an iDAO would likely give members the opportunity to keep their REP tokens if the underwriter covers the claim personally. In such cases calling the BOND market would be unnecessary. This would be an attractive choice for most active underwriters, since REP tokens have greater powers than BOND tokens.

- The REP-to-BOND market is designed to prevent a 51% attack. When a claim is made, the REP encumbered in the insurance contract is burned. Then BOND tokens, which have no governmental power in the DAO, are minted in sufficient quantity to cover the claim. BOND tokens pay off in the future through the REP salary. Through this mechanism a 51% attack is inhibited and the iDAO is strengthened, because only those underwriters who prove competent at issuing insurance contracts according to the standards of the iDAO are given REP power.

Properties engendered[edit | edit source]

- More transparent than traditional insurance companies, therefore an iDAO can be continually audited, and so may be more trustworthy

- More stable because risk is more decentralized and diversified

- More meritocratic (rewards and punishment are more isolated on the active underwriter)

- Democratized access to participation at all levels

- Incentivizes policing since all members suffer if a contract is insufficiently covered by encumbered REP

- Group doesn’t suffer directly when a claim is made (except loss of future premia). Loss is limited to the underwriter who wrote the contract. In fact, weak underwriting skills is naturally discouraged, since underwriters who choose untrustworthy customers will automatically lose their REP stake.

- Capital reserve holdings can be securely decreased (see below), since the market covers more value than traditional premium pricing models which rely on immediate premium inflows.

- ZK proofs allow the insured to share more information without sacrificing privacy. This minimizes adverse selection, leading to more accurate actuarial approximation of probability of loss, which leads to more efficient markets for coverage, which is better for both the insurers and the insured.

Health[edit | edit source]

We define an iDAO to be healthy at the moment if

- The governance process of validating insurance contracts is functioning properly. I.e., the DAO accurately valuates REP tokens and guarantees sufficient REP is encumbered to cover a claim. Further, it has done so in the past for all existing contracts.

- The market has not invalidated previous estimates. I.e., all existing contracts have sufficient REP encumbered to cover their claims, despite market changes to REP valuation since the contracts were written.

- The REP-to-BOND market is liquid.

- There is sufficient demand for insurance, and there are sufficient numbers of underwriters to write contracts in the future to maintain premia at the rate estimated for previous valuations of REP tokens as stipulated in all previous contracts.

- The contracts are approximately independently distributed probabilistically.

For example, an easy way to see how an unhealthy iDAO can fail is if assumption #5 is completely violated. If every single customer claims simultaneously, then stops paying premia, and no other customers sign contracts in the future, then the BOND market will fail. However, in that situation of extreme non-independence, all of the underwriters were not doing a very good job of finding diverse populations of customers, and so deserve to fail.

Even in this example, however, if the market is at all liquid because there is some percentage of underwriters who continue to write contracts that earn premia for the remaining REP tokens, then the iDAO is likely still succeed. To see this note there is no difference to REP valuation between the three following situations: 1. bad underwriters write bad contracts and so convert their REP tokens to BOND tokens to pay out claims, or 2. the bad underwriters stop working and wait for the REP salary to pay out their existing REP value, or 3. the bad underwriters take a graceful exit. Further, in any of these situations the iDAO is eliminating bad underwriters while only paying them a fair valuation of their REP holdings' worth. Since the bad underwriters' REP holdings were achieved by enriching the rest of the underwriters through the REP salary, we see that paying the bad underwriters through #2 or #3 is still fair. This shows how robust the DAO underwriting mechanism is against sub-populations colluding to destroy the value of any particular iDAO, unless they constitute the entire DAO, in which case the value being destroyed is just.

Capital reserves[edit | edit source]

A capital reserve in a traditional insurance company[3] is a treasury of capital (equity, cash, bonds, etc.) set aside for future insurance liabilities, to cover risk beyond the present period’s premia collection. The size of an iDAO's capital reserve holdings is an important issue. If the reserve is too small, there is greater risk of iDAO insolvency and ruin. If the reserve is too high, the holding costs of the liquid cash increases the costs of insurance. The negotiation between these two negative inevitabilities is illuminated by analyzing an iDAO's value at risk (VaR).

For an iDAO insurance contract, when a claim is made, money to cover the claim can be taken from two sources:

- iDAO treasury of capital reserves

- REP-to-BOND market. (The encumbered REP tokens are burned and equivalent BONDs are minted and sold at market for immediate cash to cover the claim. If enough REP was encumbered at the point the contract was sold and validated by the DAO, then there is no problem. If it wasn’t enough, then the treasury is necessary, or more BONDs needs to be minted, which diminishes all members’ REP value.)

This second source of coverage for claims gives a new twist on classical ruin theory[4]: The reserve treasury is unnecessary if there are enough fees coming in to guarantee that the future value of REP is sufficient for the REP-to-BOND market to cover claims. The uncertainty of future fees, however, leads to the necessity of calculating the probability of ruin for any given reserve level.

In an iDAO, reserve holdings can be dynamically and algorithmically governed to optimize for security and premium cost. For example, when the value of REP tokens decreases, the iDAO can automatically stipulate a percentage of premia are earmarked to build the reserve. When the value of REP tokens increases, the reserve can be diminished and paid out to REP holders. This mechanism gives iDAOs another tool for increasing their efficiency, but it is a positive feedback loop (which is bad from an engineering perspective) which should be governed carefully.

An economic analysis of the need for capital reserves requires the analyst to specify what utility they are optimizing for. In insurance the question is how much risk is tolerated compared with how much insurance premiums cost. Under the assumption of infinite tolerance for risk, an argument exists concluding no capital reserves are always optimal for maximizing profit.[5] Under those values, even though the underwriters risk periodic iDAO bankruptcy and default, it can be more profitable in the long run to function without the holding costs of liquid reserves. However, a more nuanced approach is to calculate the estimated relationship between risk of insolvency and cost of insurance. This allows an iDAO to disclose the danger of ruin and calculate the difference in premia between 0 chance of ruin but higher premia (complete coverage of risk with reserve holdings) versus positive chance of ruin but lower premia.

Capital reserve holdings are a contentious issue in traditional economics. In the example of banking, regulatory agencies such as the BIS, the IMF, the Fed, and the World Bank have had differing regulatory standards at different times in history (Bretton Woods Agreement, Basel III, e.g.) to manage different types of lending risk. After a global meltdown, regulation tightens. After a decade of security, regulations loosen. This leads to cycles of security crises. Economists don't have any complete model for authoritatively answering how large a capital reserve should be, since there are many competing variables which hold differing explanatory capacity in differing market circumstances.[6] But traditional economies enjoy the advantage of regulators with asymmetric information and power. A central bank can manipulate their interest rates or reserve holdings standards with greater freedom than a DAO. Those regulators do not need to justify or publish their reasoning with complete models.

Web3 primary DAOs, on the other hand, demand far more explicit and rigorous regulatory rules than traditional firms, because of their openness to pseudonymous members, their open source operating procedures, and their transparent financial transactions. Fortunately, these very weaknesses to attacks are also sources of potential strengths. Algorithmic execution of smart contracts in open decentralized platforms gives an unprecedented level of transparency which leads to more perfect markets, which leads to greater predictability. Information asymmetry is minimized. Further, transaction costs are diminished with electronic self-execution of smart contracts. Further, decentralization encourages diversity, which promotes deep and fluid markets, leading to greater stability.

In an iDAO, the size of the capital reserves does not always need to cover 100% of estimated risk[7] to prevent the threat of agency ruin, because there is also value in the equity stock of the company and in market inertia (i.e., a DAO's history of fair business even after temporary random setbacks is valuable). This is part of the reason for a common gulf between theoreticians and practicing financiers. Researchers often require an insurance firm to cover 100% of risk with capital reserves in their models, but in practice, laws in certain insurance realms only require 8-12% of the risk to be covered with the reserve. The value of the company in some cases, will itself cover the other ~90% risk. We know the company would refinance in case of temporary difficulties. The company would be willing to take a loan to cover debt for the opportunity to continue working and insuring people after a temporary setback. The proof that the company is willing and capable of covering claims, even when they are temporarily in debt, improves the company's reputation, giving them greater promise of future cash flows, which usually outweighs the debt, justifying the continuance of the insurance agency.

This gap has not been investigated exhaustively in the economic literature. Older companies may deserve to enjoy the gap in full coverage. But younger companies with less track record and less talent and inertia will not deserve the same gap—nascent companies should ideally be collateralized 100%. In the case of new Web3 insurance companies, with zero track record and little accountability, such regulation should explicitly include that valuation of the company to give continuous formulas for determining the required reserves, not with discrete jump standards imposed by the existing governmental bureaucracies which are not responsive to the market.

In our case, REP in an iDAO is a hybrid financial tool with 3 functions:

- REP is equity since it gives claims on future iDAO profits through the REP salary.

- REP is also a utility token, because it is required to participate in new underwriting.

- REP tokens are essential to the process of covering claims, so they are constantly revaluated through the REP market.

The amount of reserves necessary for mitigating risk of ruin in an iDAO is dependent on incoming fees (as usual) and future value of existing REP tokens as equity (based primarily on existing contracts and secondarily on the history of the DAO) and as utility. So, as long as underwriters are doing their jobs, there is then less need for reserves. How much less?

It depends on the existing contracts relative to the quantity of active REP and the risk of those contracts being claimed or defaulting. That depends on many factors, such as the current health of the systems being insured as measured by actuarial statistics and historical inertia. The short answer is: we don’t know. We cannot precisely know how much an insurance company is worth because of the large amount of risk it covers. It has a high variation, depending on how many premia the iDAO will earn in the future.

However, if we can get a good estimate on the future premia the iDAO will collect, then we can have more confidence in the precise relation between the size of reserve and the risk of iDAO ruin. We make this relation clear below, by formulating the explicit dependence on the increase or decrease of premia.

So we need to trust the estimate of the future direction of the rate of premia in the DAO. If the market does not have enough inertia and decentralization to diversify the risk, giving enough stability to value the company above 0 for a long enough time to cover its contracts, then an iDAO will require a reserve which guarantees full coverage.

In general, if the fees are stable or increasing faster than interest/inflation , and faster than the valuation at the initiation of a contract, then the tokens are worth more than the estimate and no reserve is necessary, assuming the DAO is policing the contracts properly (i.e., the proper amount of REP was encumbered in all contracts to cover the risk). Conversely, if fees are decreasing, then a reserve may be necessary to prevent a death spiral. So the amount of capital reserves necessary is greater when fees are decreasing faster than predicted at the moment the contracts were valuated. In sum, the size of the reserve required is smaller when the rate of fees are increasing and larger when the rate decreases. This is partially a positive feedback cycle, because if you drop the reserve in good times, then need to save in bad times, that is difficult. Building the reserve when REP is losing its value might lead to the increased perception that REP loses its value. However, that is not correct, because a REP token is a claim on the reserve they are building. So existing REP doesn’t really lose value by building a reserve. It just delays the reward, and loses the relatively minor opportunity cost of holding the liquid cash in reserve for future claims during down periods.

Perhaps counterintuitively, if some of the public loses confidence in the particular iDAO and stops paying premia, then the overall risk of overminting BONDs to cover under-encumbered contracts may actually decrease. For example, if premia are decreasing, and so REP is losing value, then some under-encumbered contracts default, which decreases the risk exposure of the DAO to dilution of REP with BONDs, which increases the value of REP. This negative feedback mechanism naturally helps the stability of an iDAO. Any new contracts underwritten with REP after the market adjustment can be achieved with the usual procedure for valuating REP at the initiation of the contract.

Nevertheless, when premia are decreasing, that shrinks the basic valuation of REP as calculated by its function as an annuity. To remain completely covered against risk of iDAO ruin, the amount of value that the REP loses by fair valuation according to the tokenomics formulas, times the amount of REP encumbered in risky contracts, should be covered by depositing the remaining premia in reserve, to the degree that all existing contracts are covered. Then the iDAO will die if all future fees are assigned to the reserve and yet to reserve is not sufficient to cover all actual future claims. In that case the underwriters will lose all their REP value, but the customers would all be covered until the reserve is drained. That is fair, because that would mean every single contract was claimed, which means the underwriters did a terrible job and deserve to lose their REP. However, that is statistically unlikely in a large DAO. Whoever didn’t have a customer claim on the contracts the underwriter wrote, then the underwriter still has REP and so still has a claim on the remaining reserve, and can still underwrite new contracts or cash out. So the iDAO will continue to live as long as a single underwriter is still doing their job.

This all assumes the market is predictable, which relies partially on the present value formula being predictable. The reserve needs to build when the fees are decreasing and the reserve can shrink and reward underwriters through the REP salary when fees increase. (E.g., increased claims can sometimes decrease the fees, if the insured cancel their policies, or if they are dropped by underwriters who don’t want to continue to insure them, or if underwriters increase their fees.)

So the 0th order state is if the DAO values the contracts properly based on the evidence they have for REP value, then it the DAO remains sound. If they underestimate or overestimate the value, the DAO should build or shrink the reserve—1st order adjustments. 2nd order adjustments may eventually be merited if the DAO become large and stable enough for the measurements to be accurate enough to overcome stochastic errors.

What happens if everyone claims their policy at the same time when a reserve is gone? Then the DAO defaults on the claims, because no one will be getting fees, so the REP will be worthless. So we need to assume the REP market is valuable.

There are more issues that can be explored. For example, if there is an increased demand for insurance, as measured by an increase in contracts, which is reflected in an increase in premia and therefore an increase in the REP salary, then the DAO profits increase which means the salary increases. However, since more REP will be minted, a single REP token may not increase in value. [??check against tokenomics formulas.] Based on this, existing contracts may be over-encumbered (or under-encumbered if premia decrease or the market dips). How should we respond? Governance can be made to adjust the requirements based on those market forces.

Tokenomics[edit | edit source]

REP token valuation[edit | edit source]

In this section, we give formulas for valuating REP tokens in an iDAO. Since the value of a REP token depends on the performance of the DAO in the future, in particular the amount of fees it attracts, such valuation is necessarily a probabilistic estimate. But such formulas can help traders valuate the REP-to-BOND market, making it more efficient, and it will help iDAO members more accurately estimate the amount of REP required to cover claims, making the insurance contracts and the entire iDAO more secure.

Components[edit | edit source]

- iDAO ledger of all REP tokens

- Capital reserves

From REP tokenomics, we have the following definitions:

- the total number of REP tokens in the iDAO at time .

- The rate of total premia that the iDAO earns. Therefore denotes the total fees earned from the beginning of the iDAO until time .

- is the cumulative reputational salary collected for one REP token.

- is the minting ratio.

- is the base discounting rate.

- is the lifetime after which a REP token expires.

Fundamental formulas[edit | edit source]

The basic results of REP tokenomics give the present value of a single REP token with finite lifetime .

Theorem 3. (Finite Life Tokens)

The total number of active REP tokens at any time is

Actual fees are stochastic, not exponential. I.e., is a random variable. So, accurately valuating of REP is a difficult problem for the market. The best valuation depends on information about the set of all active contracts, the health of the marketplace (actuarial statistics), and on the history of the DAO and the talent of its underwriters in securing good customers (avoiding adverse selection). The larger and more decentralized the market and the iDAO membership becomes, however, the more predictable becomes, and the more accurately the formulas will reflect reality.

Risk pricing[edit | edit source]

Basic theory of premium pricing gives the fees (i.e., the premia, i.e., the price of insurance) as

This pricing principle guarantees that an underwriter who sells enough independent insurance policies, each with risk , will break even according to the law of large numbers.

Reserves vs. risk of ruin[edit | edit source]

We can use the basic tokenomics formulas to make precise the relation between the size of reserve holdings and the risk of an iDAO defaulting on its customers' claims. Given an accurate estimate of the future income of the iDAO, an estimate of the risk of that future income changing, and the risk of the customers making claims, we can quantify the relationship between the size of the iDAO's reserve holdings and the risk of the iDAO's ruin. We employ standard financial concept of value at risk (VaR).

Let be a profit and loss random variable for the period under consideration (usually an insurance cycle, such as 1 year). Loss means is negative and profit means is positive. The VaR at level is the smallest number such that the probability that does not exceed is at least . Mathematically, is the -quantile of , i.e.,

Now the size of the reserve can be tied to the risk that the iDAO is willing to bear using the bound

Therefore, Condition guides an iDAO in determining the size of the reserve at any given time to maintain a bound on the risk of ruin they are exposed to. Whenever their estimated exceeds this bound, then all premia fees from insurance contracts should be diverted from the REP salary to the treasury. When the bound is next satisfied, the fees are again paid to the REP salary along with any excess reserves. At all times, the workers who sold the contracts that gained the fees for the iDAO will still earn the newly minted REP tokens. And the treasury is still technically the property of the REP holders, because as soon as the risk decreases, the treasury is liquidated to the level that keeps the risk of ruin below and shared with all REP holders.

In the ideal case, we see that there is no need for a treasury. The ideal case assumes the fees keep pace with inflation and the iDAO is properly policed--i.e., underwriting of contracts are always sufficient to cover all claims. The treasury is unnecessary in this case, since the valuation of REP tokens can be made certain, so that so satisfies Condition .

Economic analysis[edit | edit source]

In this section we compare this decentralized scheme with the traditional insurance model, analyzing the microeconomics of supply and demand, moral hazards and adverse selection.[6] [8]

Where we stand practically in deFi[edit | edit source]

Missing:

- Oracles are not decentralized and efficient

- Adjudication

- Stable coins are not decentralized and/or efficient

- Smart contracts are not efficient

- Local legal regulatory clarity is mostly non-existent

Code[edit | edit source]

See Also[edit | edit source]

Notes & References[edit | edit source]

- ↑ David C. M. Dickson, (2005) Insurance Risk and Ruin, Cambridge University Press.

- ↑ Craig Calcaterra, Wulf A. Kaal, & Vadhindran K. Rao, (2019) "Decentralized Underwriting". Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3396542 (Retrieved 2023 March 16)

- ↑ A capital reserve is also known as an actuarial reserve, AKA technical reserve, AKA insurance reserve, AKA reserve holdings, AKA capital, AKA treasury, AKA surplus.

- ↑ Dickson (2005), Chapters 7 & 8.

- ↑ 5.0 5.1 Dickson (2005), Chapter 3.5, e.g., concludes the only optimal solutions are full coverage or none, under their particular assumptions.

- ↑ 6.0 6.1 As an example, one general model concludes that under certain assumptions, 0 reserves are required, while changing parameters in the same model leads to the conclusion that full coverage of all possible claims leads to optimal outcomes. See, e.g., Ray Rees & Achim Wambach (2008) The Microeconomics of Insurance, Now Publishers, pp 63-70.

- ↑ For a quantitative treatment of risk see, e.g., Robin J. Cunningham, Thomas N. Herzog, Richard L. London (2006) Models for Quantifying Risk (2nd ed.), ACTEX Publications.

- ↑ Hugh Gravelle & Ray Rees (2006) Microeconomics, 3rd ed., Pearson.

![{\displaystyle VaR_{p}(X)\leq \mathrm {T} (t)+E[PV(f(\infty )-f(t))]\qquad (1)}](https://wikimedia.org/api/rest_v1/media/math/render/svg/0673b1487134ab6dff1f5e1e7202a75e8c236215)

![{\displaystyle E[PV(f(\infty )-f(t))]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/1ef0676528d680b3f3aba0482f5f55ccfa17b01b)