Uniswap

Jump to navigation

Jump to search

How it works?[edit | edit source]

Overview[edit | edit source]

Uniswap is an automated liquidity protocol powered by a constant product formula and implemented in a system of non-upgradeable smart contracts on the Ethereum blockchain.[1]

Timeline[edit | edit source]

Version Evolution[edit | edit source]

| V1 | V2 | V3 | |

|---|---|---|---|

| V1 | Vyper: ETH20-ETH | NA | NA |

| V2 | Solidity: ETH20-ETH20 | NA | |

| V3 | Ethereum and Optimism | Concentrated Liquidty, Active Liquidity, Range Limit Orders.

|

Concepts[edit | edit source]

Liquidity Pools[edit | edit source]

Swaps[edit | edit source]

Constant Product Formula[1][2][edit | edit source]

x * y = k

Concentrated Liquidity (CL)[edit | edit source]

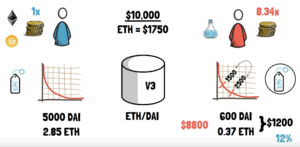

As long as the pairing of ETH and DAI stay within a range ($1500-2500), User Red who invested much less than User Blue ($1200 vs. $10,000) can still earn the same trading fees (see Figure CL).

Figure CL: An example of how Uniswap V3's concentrated liquidity concept works.[3]

Active Liquidity[edit | edit source]

Range Limit Orders[edit | edit source]

Questions[edit | edit source]

- How does the relate to DGF?

- Can it help with validation pool REP management and redistribution? [Context: Odra Collaboration]

- REP and cryptocurrencies are fundamentally different. REP is meant to be a low velocity asset that has non-fungible qualities and generally non-tradeable vs. normal digital currencies. Additionally, a validation pool is not a liquidity pool[4] and should not be treated as such.

- Can it help with validation pool REP management and redistribution? [Context: Odra Collaboration]

References[edit | edit source]

- ↑ 1.0 1.1 Protocol Overview: How Uniswap works. (n.d.). Uniswap. Retrieved November 8, 2023, from https://docs.uniswap.org/contracts/v2/concepts/protocol-overview/how-uniswap-works

- ↑ Uniswap. (2020). UniswapV2Factory.sol. GitHub. https://github.com/Uniswap/v2-core/tree/master/contracts

- ↑ UNISWAP V3 - New Era Of AMMs? Architecture Explained. (2021, March 23). Finematics. Retrieved November 8, 2023, from https://finematics.com/uniswap-v3-explained/

- ↑ Pools | Uniswap. (n.d.). https://docs.uniswap.org/contracts/v2/concepts/core-concepts/pools