Chit Fund DAO

The Chit Fund DAO (cfDAO) is a DAO devoted to decentralized banking. The cfDAO generalizes the function of traditional chit funds to make an open global deFi platform for all types of banking. The cfDAO uses DGF to manage its underwriting and governance.

Background

A chit fund is a folk banking scheme traditionally used by people without access to formal banking institutions. The term chit fund comes from India, where it is used by a significant percentage of the population, and has become legally regulated in many regions. Similar schemes are used throughout the world, especially in rural areas without formal banks.

Banking involves two money processes: deposits and withdrawals. The sequence determines the type of banking. Consider for instance, the fundamental banking practices of loans, investments, and insurance. A loan is an initial withdrawal of money followed by a series of deposits. An investment is a series of deposits, followed by a withdrawal. Insurance is a series of deposits, with a withdrawal at a random time between the deposits. These three types of banking are unified by the scheme in a basic chit fund, as illustrated next.

Basic chit fund scheme

In a traditional chit fund there are several members and an organizer. As a basic example, suppose 100 people agree to deposit $200 in the fund every month for 100 months. Each month an auction takes place, where the members can bid to receive a fraction of the current total chit fund. The lowest bid wins. Once you win an auction, you can’t win another, but you are still required to add your $200 each month until the end. So the number of members is always equal to the number of months the chit fund runs in traditional chit funds (though this stipulation is removed in the generalized cfDAO).

In this example, notice that $20,000 enters each month for 100 months. For $200 entry you can withdraw almost $20,000 in the first few months, if you bid lowest. Early winning bids will typically be from people eager to use the chit fund as a loan, so they will typically be lower than $20,000. Since the excess money remains in the fund for later bids, the fund typically grows, in which case it holds more than $20,000 later. Therefore, early withdrawal is like taking a loan that is repaid for 100 months with interest. Later withdrawal is like a bank deposit that earns interest. Others can use the fund as insurance by withdrawing when they need it at any time between the beginning and the end.

Web3 improvements

Web3 technology can greatly improve the efficiency and security of the traditional chit fund scheme.

First, smart contracts replace the organizers, eliminating the risk of an organizer absconding with the fund, and decreasing their typical 5% commission.

Second, by implementing a reputational system, honest participation can be tracked across many different chit funds, as people will earn reputation each time they pay their required monthly fee. The more often they participate honestly, the larger their reputation will grow. Then participation in larger and more complex chit funds can be dependent on reputation, which will incentivize healthy collaboration.

It will come as no surprise that one of the major overheads making this scheme less efficient is members defaulting on paying the premia. It’s been estimated that 35% of chit fund subscribers have defaulted at least once recently and 24% have defaulted after winning an auction.

All things being equal, larger groups dilute the risk of individual default. A chit fund with a large number of people with high reputation can pay small premia for insurance. 1 One million people investing $1 daily for 50 years allows 50 people per day to immediately begin taking an average payout of roughly $20,000. More investors investing smaller amounts in shorter increments, means more people can withdraw at any point. By monitoring and analyzing the performance of a fund, programs can suggest values that can be withdrawn at any given time. By automatically bidding when the fund rises above expected levels, the fund can be stabilized to give predictable returns—especially if multiple funds are connected.

With no initial reserve backing, this allows people to bootstrap their way to greater financial security and stability, assuming the reputation system is sufficiently strong to guarantee a low percentage of defaults. Further efficiency-improving mechanisms are mentioned below, where we discuss a more general architecture for underwriting.

Like other overhead costs (the appeals process, policing, etc.), insurance is cheaper when the system is running well. The more automated the decentralized economy becomes, for example, with code-is-law smart contracts, the less insurance is required. The purpose of insurance is to decentralize risk. Ideally the risk would be decentralized perfectly and then the need for insuring individual transactions would disappear. Given that no system will ever be perfect, insurance will always be essential. But by implementing the new tools of information technology and the new architectures of P2P distributed computing, we can create more effectively decentralized organizations. Decentralizing risk makes insurance more stable and efficient, which improves the economy.

However, the core difficulty in implementing any chit fund is organizing it. The primary threat is that a member will win an early bid, then fail to make the rest of the deposits--defaulting. Traditional chit fund managers make a 5% commission, for the primary goal of ensuring members do not default. This is especially challenging in a decentralized, open, global financial scheme. How do we guarantee the default rate is low enough to justify participation from pseudonymous participants? To solve this problem, the chit fund needs to be insured against the risk. Therefore, the members of the cfDAO require underwriting.

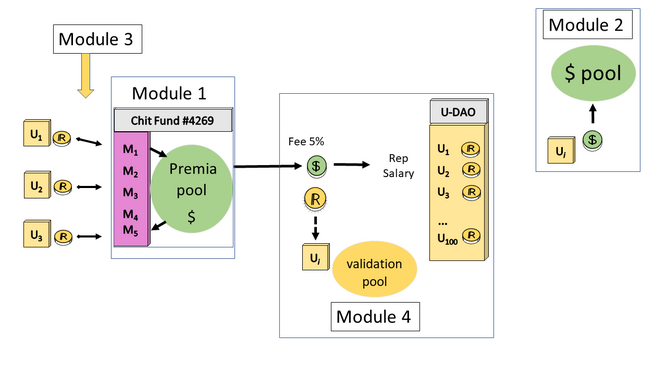

Basic cfDAO function

The cfDAO relies on an underwriting DAO (uDAO).