Decentralized underwriting

Jump to navigation

Jump to search

??Insurance DAOs (iDAOs) for creating decentralized underwriting markets, based on this paper.[1]

Insurance DAO protocols

Components

- DAO = {Underwriters}

- Underwriter ∋ REP tokens a) Propose contracts with REP b) Police contracts with REP

- Insurance contract (Work smart contract)

- Validation Pool

Token scheme

Workflow

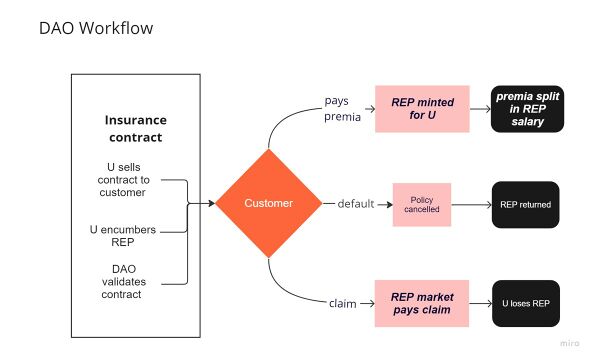

(See Figure 1.)

- Underwriter sells a contract to a customer.

- encumbers the canonical amount of REP in the contract.

- Contract Validated by DAO.

- Customer a) pays premia, or b) defaults, or c) claims

- DAO a) mints REP for proportional to premia & distributes REP salary, or b) cancels contract, or c) pays claim by selling encumbered REP at market

Consequences

Properties engendered

- More auditable/transparent

- More stable, trustworthy

- More meritocratic (rewards and punishment are isolated to the agent)

- Democratized access to participation at all levels

Tokenomics

Capital reserves can be eliminated

economic justification

Where we stand practically in deFi

Missing:

- (d) oracles

- *adjudication

- (d/e) stable coin

- (e) smart contracts

- regulatory clarity

Code

See Also

Notes & References

- ↑ Craig Calcaterra, Wulf A. Kaal, & Vadhindran K. Rao, (2019) "Decentralized Underwriting". Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3396542 (Retrieved 2023 March 16)